Using Dashboards to Help Close the Wealth Gap

by Taymour | October 26, 2021

Achieving Financial Equity

Imagine closing the racial, gender, and generational wealth gaps by 2040. Achieving this type of financial equity is the goal of Impart Media—a start-up with a noble cause. The company's mission is to help people of all backgrounds build financial security by leveling the playing field through information. To this end, Impart created a Money Matters YouTube channel and the Hive Wealth app as alternative vehicles for providing relevant, guilt-free financial information. They believe everyone—regardless of race, age, or gender—should have access to the quality financial advice that was previously relegated to just a few.

Money: The Last Taboo

The topic of money should not cause shameful feelings. Both their YouTube channel and app provide useful financial information without making anyone feel embarrassed about where they currently are in their journey to improved financial decision-making. No longer are sound investment strategies accessible to only the wealthy (many of whom have amassed their fortunes intergenerationally via inheritance). Money matters to everyone, irrespective of who they are and their financial circumstances.

The Hive Wealth App

Before achieving improved financial performance, people must be able to baseline their wealth, or net worth (the amount left over after subtracting liabilities from assets). For example, from a generational point of view, it wouldn't make sense for Gen X-ers to compare their net worth to Boomers, who have had more time to accumulate wealth.

Demographic differences in net worth exist not only among different generations, but also among different genders, races, and other demographics. The Hive Wealth app enables members to compare their financial situations across demographics and financial circumstances. The overarching objective, as previously stated, is to narrow the wealth gap by providing insight into what that gap looks like. To achieve this aim, however, we needed a reliable data source to benchmark performance that can be divided into different groups based on demographics, financial net worth, assets, and liabilities.

Identifying the Right Data

To identify the right data, we needed to understand what data was available, how it was organized, and how accurate it was. After some initial research, we decided on the Census Bureau's Survey of Income and Program Participation (SIPP) as our data source. The SIPP provides detailed information on income, assets, and liabilities for a representative sample of US households. To give a sense of its depth and breadth, the SIPP data dictionary is more than 3,000 pages.

US Census: Survey of Income and Program Participation

The Survey of Income and Program Participation (SIPP) is an important information source that helps us understand the economic situation of people in the United States. It provides detailed information on income, taxes, assets, liabilities, and participation in government transfer programs. This data allows policymakers to evaluate federal, state, and local programs’ effectiveness.

The Department of Health, Education, and Welfare (HEW) developed SIPP in 1975. HEW spent the next five years collaborating with the Census bureau to test and develop a longitudinal survey, as part of the Income Survey Development Program. They conducted the first nationwide test of 2,000 homes in 1978, and in 1979, they interviewed a truly representative national sample of 8,200 households.

SIPP officially launched in October 1983, after the Census Bureau received funding that year which allowed work on SIPP to continue. The Bureau designed the survey to assess a national household sample, and they interviewed every person aged fifteen or older. Four months after the initial interview, respondents were surveyed again; this process was repeated over thirty-two months. Each February, they interviewed a new group of respondents, creating an overlapping series of survey panels. The Census Bureau revamped the SIPP in 1996 by conducting a single, larger panel over four years and interviewing respondents twelve to thirteen times per year. Additionally, they introduced computer-assisted interviewing (CAI), which expedited data processing and allowed for real-time answer accuracy checks. SIPP is one of the best and most comprehensive ways to assess typical Americans’ financial well-being.

Using Hive Segments to Benchmark

The Hive Wealth app categorizes its members into hives. The hives are broad at first, with two age-based categories: Generation X or older and Millennials or younger. The app then compares these members’ net worth information (a measure) to SIPP-provided data. Even though the hives were broad, this benchmark establishes a framework to baseline wealth. Just like a human cell that splits to create more cells, the hives will split based on other demographic criteria. To be sure, SIPP has a variety of demographics that can further refine the hive segments. The measurement data used to benchmark financial information initially only included net worth. However, because the net worth measure is calculated by subtracting total assets from total liabilities, those two groups could be used as benchmarks. Moreover, even these two measures can be broken down into more specific measures. Total assets, for example, include assets held at various financial institutions, the amount of money in stocks and mutual funds, and the value of any primary or secondary residences. Liabilities operate similarly; they may be divided into credit card debt, business loans, education debt, and so on.

Visualizing the Data

newData's dashboard development services seemed like a logical place to start. The company offers a wide variety of options for data visualization using Microsoft Power BI as well as Salesforce Tableau and IBM Cognos. Unfortunately, weighing the data isn’t possible. The good news is that newData created a calculation using Power BI's DAX programming language. Given survey design’s complexity, the newData team worked directly with an economist at the Census' Labor Force Statistics Branch’s Social, Economic, and Housing Statistics Division to ensure that filters were applied correctly.

To ensure that the dashboard was accessible to business users, it was important to keep it simple. Therefore, the SIPP dashboard consisted of two pages:

- Main Page

- Cross Tabulation Page

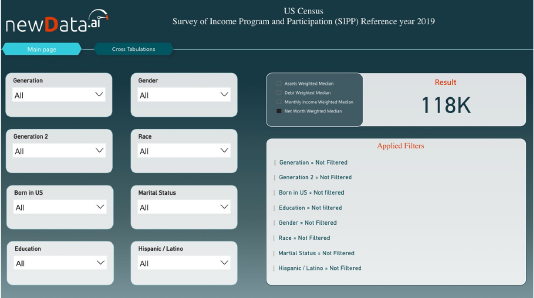

Main Page (Example A)

At the time of this writing, the dashboard consists of eight demographic dimensions and four measures. Each demographic element can be applied individually or jointly with other demographic elements. Moreover, the dashboard allows users to choose among four measures: Net Worth (Total Assets - Total Debt), Total Assets, Total Debt, and Monthly Income. Because of the large skews in financial data, the results were calculated using the median as the preferred statistic. Without any demographic filters applied, the median net worth for the 2019 reference period was $118K.

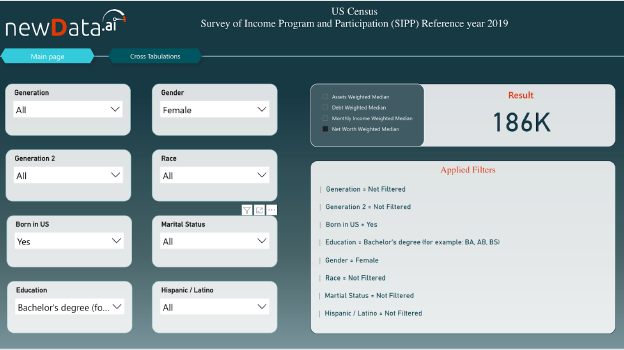

Main Page (Example B)

The above screenshot shows that the median net worth jumps to $186K when you apply three additional filters:

- Education: Bachelor’s degree

- Gender: Female

- Born in US: Yes

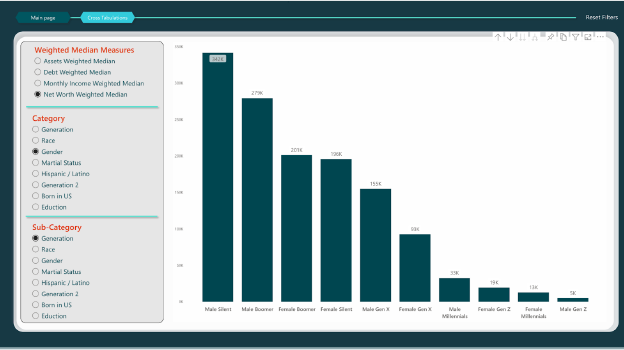

Cross-Tabulation Page

The dashboard is also capable of visually combining two demographics for each measure. The above screenshot illustrates two gender categories by four generational categories to determine net worth. Generating insights from the visualization is easy. For example, net worth is higher for every generation, with the exception of Gen Z, in which the female net worth is higher than the male net worth. This conclusion, however, may change as more Gen Z-ers are added to the SIPP survey.

Integrating the results

Helping Closing the Wealth Gap

newData used SIPP data to develop a dashboard for the Hive Wealth app using Power BI, an interactive data visualization software product Microsoft developed with a primary focus on business intelligence. The business objective was to enable Impart to benchmark its members' net worth and other financial information across demographics and thereby allow its members to see how they were doing fiscally compared to similar Hive Wealth members.

Through the power of accurate information and sound advice, Impart Media is taking steps to close the wealth gap and create a more financially inclusive world.